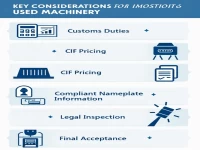

Customs Exemption Nature Code Explained

The customs duty exemption nature codes are important tools for classifying import and export goods. This article provides a detailed overview of the classification of exemption categories, including statutory taxation, tax reductions, and specific tax exemptions, along with detailed definitions and applicability related to various types of import and export goods. This information is crucial for understanding tax management in international trade.